Calculations RM Rate TaxRM A. If your income falls below the governments.

10 Things To Know For Filing Income Tax In 2019 Mypf My

Last reviewed - 13 June 2022.

. Change In Accounting Period. When you file your income tax this 2019 make sure to have a good hard look at your expenditure from the year before so you dont miss out on any tax relief you can claim for. Tax Relief Year 2019.

13 rows An individual whether tax resident or non-resident in Malaysia is taxed on any income accruing in or derived from Malaysia. For both resident and non-resident companies corporate income tax CIT is imposed on income. In 2019 mean income in Malaysia was RM7901 while Malaysias median income recorded at RM5873.

Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. The Annual Wage Calculator is updated with the latest income tax rates in Malaysia for 2019 and is a great calculator for working out your. The amount of tax relief 2019 is determined.

Lets take a look at some of the scenarios where these tax exemptions maybe applicable in Malaysia. The average salary in Malaysia is 79000 MYR. The income tax filing process in Malaysia.

Malaysias 2019 Budget will see an increase in stamp duties to 4 from 3 for transfer of real properties that are RM1 million and higher. Malaysian Government imposes various kind of tax relief that can be divided into tax payer. Amending the Income Tax Return Form.

Malaysia was ranked 12 out of 190 countries for ease of. Corporate - Taxes on corporate income. There will be a two-year stamp duty.

This means that low-income earners are imposed with a lower tax rate compared. The amount of tax relief 2019 is determined according to governments. Budget 2019 Finance Bill 2018 Income Tax Amendment Bill 2018 and Labuan Business Activity Tax Amendment Bill 2018.

Monthly Tax Deduction 2019 for Malaysia Tax Residents optionname00 Allowance Bonus0000 - Allowance Bonus. Basis Period for Company. Now that youre up to speed on whether youre eligible for taxes and how the tax rates work lets get down to the business of actually.

The non-resident tax rate in Malaysia is. Personal Tax Relief Malaysia 2019 Madalynngwf Wef 1 January 2022 foreign-sourced income of tax residents will no longer be exempted when remitted to Malaysia. Pay less tax to take.

Malaysia Annual Salary After Tax Calculator 2019. Personal income tax rates. On the First 5000.

Income tax in Malaysia is imposed on income. On the First 5000 Next 15000. Tax relief refers to a reduction in the amount of tax an individual or company has to pay.

Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia.

Cukai Pendapatan How To File Income Tax In Malaysia

Lhdn Irb Personal Income Tax Relief 2020

Malaysia Tax Revenue 1980 2022 Ceic Data

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

How To Submit Income Tax 2019 Through E Filing Lhdn Malaysia

How Much Does A Small Business Pay In Taxes

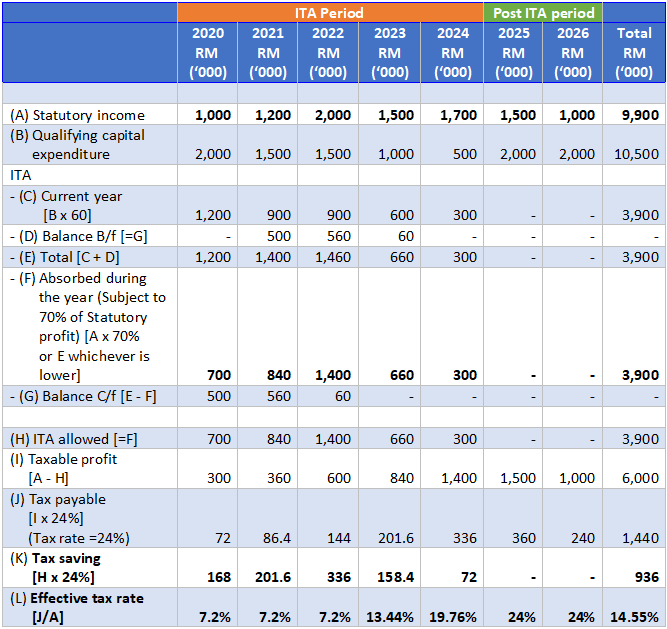

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Download Kwsp Income Tax Relief 2019 Gif Kwspblogs

Individual Income Tax In Malaysia For Expatriates

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Malaysia Personal Tax Relief Ya 2019 Cheng Co Group

Everything You Need To Know About Running Payroll In Malaysia

Personal Income Tax Malaysia 2019 Nashcxt

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

Gst In Malaysia Will It Return After Being Abolished In 2018

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

7 Tips To File Malaysian Income Tax For Beginners

Deadline To File Income Tax 2019 Malaysia